George Anderson

If the year of the pandemic taught us one thing, it’s this: Expect disruption.

That’s been true in all areas of life, and we’ve definitely seen it in the world of B2B ecommerce. The trends that have emerged in the wake of the pandemic look a little different than the predictions of analysts and vendors c. 2019.

So where are things headed in B2B ecommerce? What trends matter for your business?

Here are the top eight trends we’re seeing driven by the market at large:

1. Manufacturers are rolling out B2B ecommerce to existing customers first.

While marketing materials on B2B ecommerce platforms tend to focus on reaching new customers, we don’t see this preference among manufacturers.

In fact, we see the opposite. Organizations are choosing an incremental approach, launching B2B ecommerce for existing customers first. Onboarding this captive audience of dedicated buyers can create a quick win—and it demonstrates the viability of B2B ecommerce to internal stakeholders. Organizations that choose a scalable solution (one with built-in ERP integration) are primed to grow their market footprint after transitioning existing business to B2B ecommerce.

2. Pressure is building to make the organization more efficient through B2B ecommerce.

There are three common drivers that push an organization to adopt B2B ecommerce.

- The need to improve customer experience

- The need to grow revenue

- The need to cut costs and become more efficient

Usually, all three drivers coexist at any given organization. Yet we’re seeing an increase in organizations looking to become more efficient—particularly manufacturers that still rely on phone, fax and email for order placement and order inquiry. (Incidentally, replacing those processes with B2B ecommerce not only increases efficiency—it also improves customer experience. But we digress!)

While global economies have already begun to recover from the impact of COVID, life is still very different in the B2B world. Reduced workforce availability and unusual lead times for order fulfillment have put more pressure than ever on B2B organizations. Any saving of cost or time in the OTC (order-to-cash) cycle is a welcome benefit, and B2B ecommerce is the primary driver of increased efficiency here.

3. The death of the non-integrated B2B proof of concept.

This B2B trend is directly related to the first. If you’re going to take an incremental approach, starting with existing customers, you need a solution that can actually meet their needs for real-time ERP data and logic. Without features like personalized pricing or real-time inventory and credit status in B2B ecommerce, existing customers won’t be able to do business with you.

Right away, that rules out the disconnected B2B ecommerce proof of concept. If existing customers can’t use it, it doesn’t really prove anything to them (or the organization). This problem is pushing organizations to get serious about ERP integration from the very beginning.

4. Everyone wants “quick win” customer portals that scale up to B2B ecommerce.

We saw this trend before the pandemic, but COVID intensified it.

Many organizations, particularly manufacturers, get nervous when they look at giant B2B ecommerce platforms and rollouts that take a year or more. They may dream of having that flashy catalog and all those merchandising capabilities, but if they can’t get their product content together—or they can’t imagine how their complex business processes will translate to a B2B ecommerce experience—then they have a hard time committing.

This is why manufacturers are starting their digital journeys with customer self-service portals. With an ERP-integrated solution, manufacturers can launch a portal for routine post-order care. This empowers existing customers to track orders, invoices and payments on their own—without calling customer service.

A successful portal gives manufacturers the cost savings (and the internal political capital) to get more ambitious with B2B ecommerce. The key is to choose a portal solution that 1) includes ERP integration, and 2) expands to full B2B ecommerce functionality on the same ERP-integrated architecture.

5. Marketplaces are forcing manufacturers to define their B2B ecommerce strategy.

Are online marketplaces friends or foes of manufacturers?

Actually, they’re both.

Online marketplaces offer incredible opportunities in B2B ecommerce. Yet they have no incentive to protect a manufacturer’s interests. Fundamentally, the interests of online marketplaces are not aligned with those of any one merchant. Their algorithms will suggest a different product if that’s what it takes to get the sale.

So what does this mean for manufacturers?

It means these organizations must define their B2B ecommerce strategies. That could mean a marketplace presence, or it could mean a privately owned B2B ecommerce store—or both. The answer depends on factors like how commoditized your products are and how much B2B ecommerce data you want to gather. (You can gather far more data from a privately-owned B2B ecommerce solution.)

6. Millennials are pushing organizations to deliver great B2B ecommerce experiences.

Millennials’ first priority in choosing vendors is the ease of doing business. This stands in contrast to Gen X (who prefer quality of service and products) and Baby Boomers (who prioritize getting things fast), according to an IBM report on Millennials and B2B marketing.

“Ease of doing business” means different things at different organizations. However, for manufacturers whose entire business lives in the ERP, it means one thing for sure. B2B ecommerce should provide the same personalized, real-time ERP data that millennials could get over the phone—because they’re not going to pick up the phone if they can help it.

7. After COVID, digital self-service is the new normal in B2B sales.

COVID pushed B2B sales away from human interaction and toward self-service. At the height of the pandemic, analysts were predicting that this shift would last permanently. Many organizations weren’t ready—and many are still grappling with the repercussions of not having a self-service digital channel.

But is the shift still in effect?

Absolutely. Check out this amazing set of interactive graphs from McKinsey & Company. No matter how you slice it, digital self-service is dominating the B2B buyer journey. That trend is pushing B2B organizations toward ecommerce and customer portals.

8. Mobile is growing fast, but it’s still a small segment of total B2B ecommerce traffic.

At this point, there’s no question you need a mobile-optimized experience (and no question that you can deliver one with any major platform). Any B2B ecommerce platform worth its salt should work great on mobile.

But how dominant is mobile, really?

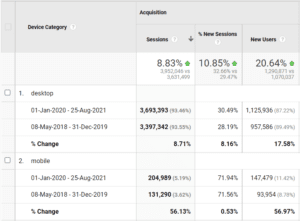

Here’s what the data says for Corevist clients, who are primarily manufacturers running on SAP ERP. This data compares the period Jan. 1, 2020 – Aug. 25, 2021 to the previous period (May 8, 2018 – Dec. 31, 2019) for all Corevist clients in aggregate:

Here are the takeaways:

- Yes, mobile is growing fast, climbing 56.13% over the last three years.

- But mobile still accounts for a small fraction (3-5%) of all sessions on all Corevist Commerce storefronts.

- Desktop is still the dominant device for manufacturers’ customers, delivering 93% of all sessions on all Corevist Commerce storefronts.

The Takeaway

While the digital landscape continues to shift rapidly, there’s no more exciting time for organizations to explore B2B ecommerce. With diligent market research and deep understanding of customer needs, B2B companies can find new opportunities to win with ecommerce and customer portals.

George Anderson is a marketing manager at Corevist Inc., which provides manufacturers with software to launch B2B ecommerce portals integrated with SAP ERP software. Connect with him on Twitter or LinkedIn. A portion of this article first appeared on the Corevist blog.

Favorite