Key Ecommerce Statistics on Housewares & Home Furnishings Category – Snapshot

HOUSEWARES & HOME FURNISHINGS

Buying Housewares & Home Furnishings Online

|

|

|

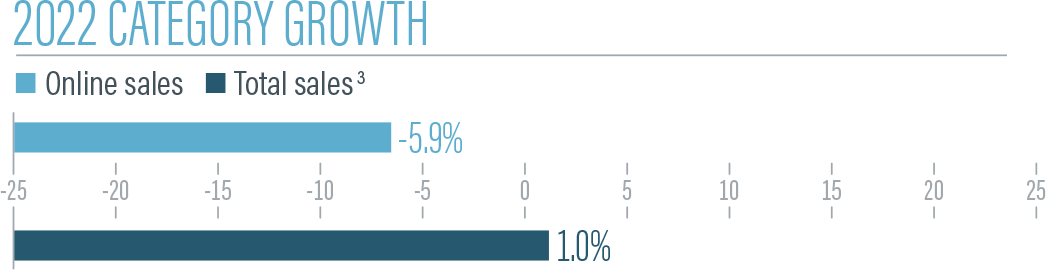

Online sales decline for housewares & home furnishings

It was a tumultuous 2022 for the housewares/home furnishings category. The fall of long-beleaguered Bed Bath & Beyond Inc., and 30% decline in growth for Overstock.com Inc., were two standouts in the category.

However, consumers are still buying to update their homes. The mean conversion rate increased to 2.4% in 2022 compared with 2.3% the year prior.

Inflation played its part as the median average ticket increased to $501 in 2022 compared with $403 from less shoppers. In 2022, there were 413,200 median monthly unique visitors. That is a drop from 479,975 in 2021.

|

|

Online furniture sales growth slows, but is still strong with $42.83 billion in sales

There was a slowdown in overall category sales. U.S. Top 1000 online category sales reached $42.83 billion in 2022, down from $45.53 billion in 2021. That places Top 1000 online share of total retail sales (both in store and online) in the category at 29.9% — a decrease from the 32.1% penetration in 2021. U.S. total category retail sales reached $143.32 billion in 2022. That’s up from $141.96 billion in 2021, suggesting that more consumers shopped at brick and mortar locations last year.

|

There are 115 housewares/home furnishings retailers in the Top 1000.

While U.S. Top 1000 online category sales reached $42.83 billion in 2022, online sales in the category decreased 5.9% in 2022. That’s a sharp drop from the 8.1% online sales growth in the category in 2021. And it falls short of the modest 1.0% growth rate of overall digital and brick-and-mortar sales in the category last year, according to a Digital Commerce 360 analysis of U.S. Department of Commerce data.

|

|

|

Who buys housewares and furniture online?

In May 2023, Digital Commerce 360 and Bizrate Insights surveyed 1,038 online shoppers and asked how their purchasing behaviors in the home goods category. Six out of 10 online shoppers purchased 26% of their home goods online in the past year.

Online shoppers continue to research home goods and cross-category buying as they upgrade their homes. Part of the home needs included:

- 47% – Upgrades to their homes

- 38% – DIY projects

- 13% – Moving to a new home

- 12% – Kicking off contractor projects

42% of online shoppers hunted for deals by taking advantage of promos on products of interest. 68% of online shoppers said the right price drove conversion, followed by 61% who wanted free shipping.

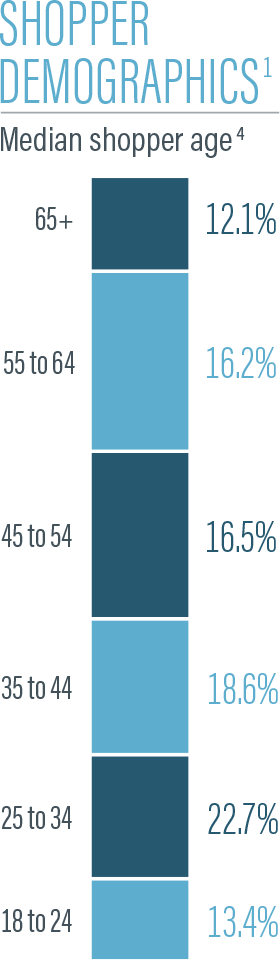

The shoppers are men and women across all age groups. They skew younger, as more than half of shoppers who purchase housewares/home furnishings from Top 1000 merchants — 54% — are 44 years old or younger.

|

|

|

Source: Digital Commerce 360 1. Digital Commerce 360 analysis of SimilarWeb traffic data. 2. Includes only U.S. sales from the sites of U.S.-owned retailers for consistency with the U.S. Department of Commerce’s methodology. 3. Digital Commerce 360 analysis of U.S. Department of Commerce retail data. 4. Medians won’t sum to 100%

Hardware & Home Improvement Category News Feed