The pandemic forced Daniel’s Jewelers to change its sales approach.

Daniel’s Jewelers, founded in 1948, was almost entirely an in-store retailer in 2019. 0.001% of its sales came from its ecommerce website that year, says Sam Sarullo, head of ecommerce and marketing.

It launched a new ecommerce website in early 2020, just two weeks before the COVID-19 pandemic hit. And shortly thereafter, it launched curbside pickup.

“Whether it was divine blessing or a horrible baptism by fire … all that traffic flushed over to the website,” Sarullo says.

As shopper behavior changed in response to pandemic restrictions, customers who previously only shopped in the retailer’s physical stores then fell into three categories, he says.

One group embraced the retailer’s new online shopping experience. The retailer processed 200 orders a day in 2020, up from about two orders a day in 2019 he says.

Another group did not want to go to physical stores because of health concerns but also did not want to purchase jewelry online, he says. The third category still wanted an in-store shopping experience.

There came a point in the pandemic when retailers could bring staff back into stores, but shoppers still could not enter.

“So we started to pivot toward a curbside pickup model when we could get staff into the stores at a reasonable time,” Sarullo says.

This, however, was an operational challenge because Daniel’s physical locations are in large malls and strip malls. Unlike larger retailers with their own parking lots, there was no reserved parking for Daniel’s shoppers, let alone curbside pickup parking spaces. But Daniel’s managed to make this work.

Daniel’s contacted customers by email when orders were ready, providing that location’s store hours. It would give customers a phone number to call upon arrival. Employees would then get the packages and meet customers at the appropriate door. Some malls had shared curbside drop-off locations, similar to those for ride-sharing services at airports, Sarullo says. Others didn’t have anything designated.

“And we never had anything specific just for Daniel’s due to the shared mall concept,” Sarullo says.

Daniel’s informed customers about the process in both order confirmation emails and on the FAQ and shipping pages on its website. It said because all locations vary on curbside processes, a customer would get instructions once they called their local store upon arrival. Daniel’s also encouraged customers to call before setting out to pick up their order if they wanted specific instructions before arriving at the mall.

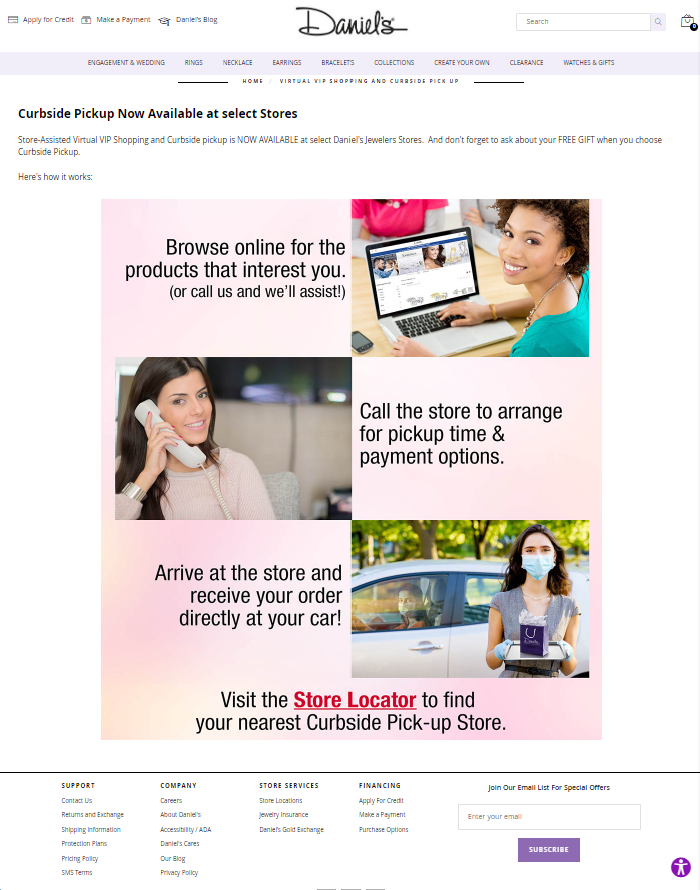

Daniel’s Jewelers informs its shoppers about its Store-Assisted Virtual VIP Shopping and curbside pickup at select locations.

“We were bending over backwards to make it work to keep our customers happy,” he says.

The sharp increase in retail chains offering curbside pickup started in 2020, according to Digital Commerce 360 data based on the 179 retail chains in its Top 1000 database. In 2019, less than 9% of retail chains offered curbside pickup, and 8.4% of those retailers offered the service in 2020, according to Digital Commerce 360 data. This increased to 53.6% of retail chains offering curbside in 2021 and 54.7% in 2022.

Now that COVID-19 restrictions are gone, and shoppers have largely returned to in-store shopping, retailers must decide whether to commit to offering curbside pickup or whether they should drop it and stick to home delivery and store pickup.

Some merchants are starting to discontinue the service. Digital Commerce 360 data from March 2023 shows that not even half — 44.1% — of retail chains in the Top 1000 still offer curbside pickup. But many consumers still like curbside pickup and want to continue using it.

Curbside pickup at national retailers

Among larger retailers, Target Corp. continues to offer curbside pickup, which it refers to as Drive Up. A Target spokesperson told Digital Commerce 360 in an emailed statement that Drive Up is the retailer’s top-rated fulfillment service. The spokesperson said Target plans to enhance the service.

“This spring, Target will roll out Returns with Drive Up to our nearly 2,000 stores nationwide,” the spokesperson said. “Our guests asked for this enhancement … and we’re delivering. The service will begin to roll out chainwide this spring and is scheduled to be complete by the end of summer.”

Walmart Inc. chief financial officer John Rainey said in the retailer’s earnings call for the fiscal fourth quarter ended Jan. 27, 2023, that Sam’s Club ecommerce sales grew 21% year over year. He attributed the growth to curbside pickup as well as ship-to-home sales.

BJ’s Wholesale Club Holdings, Inc. CEO and president Bob Eddy said on a fiscal Q4 earnings call with investors on March 9 that curbside pickup now accounts for 50% of the retailer’s digital sales.

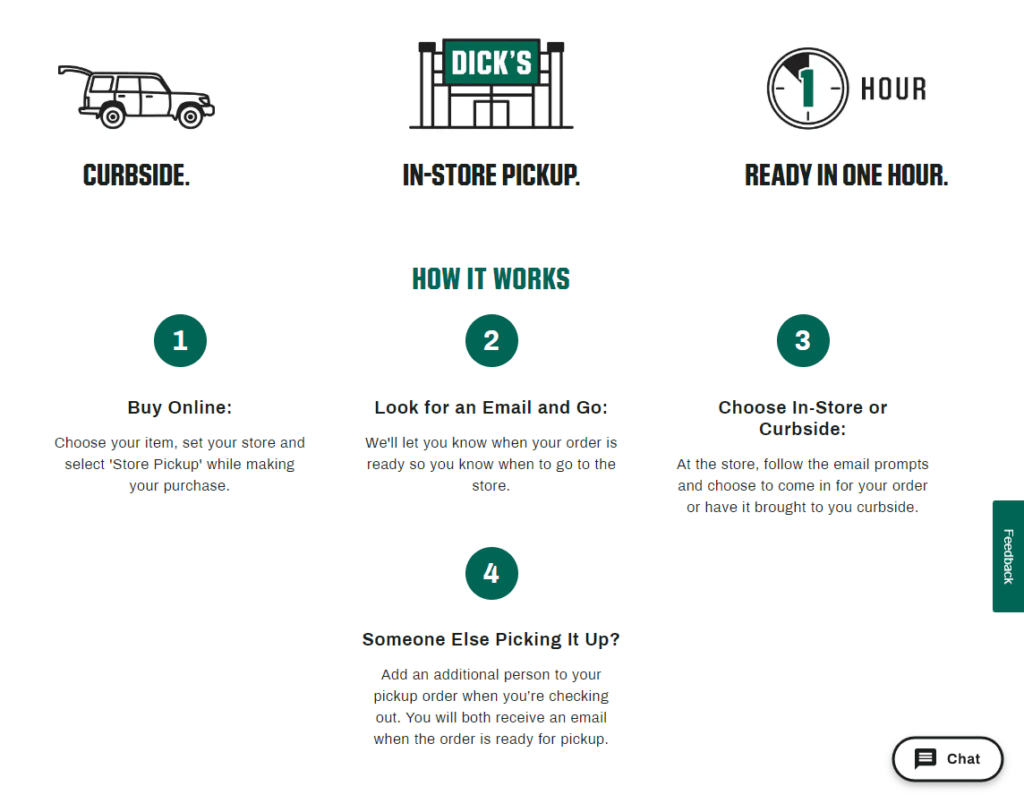

Dick’s Sporting Goods plans to continue its one-hour curbside pickup service, according to an emailed statement from a spokesperson.

Athletics retailer Dick’s Sporting Goods displays instructions on its website for store-pickup options.

In contrast, apparel chain Kohl’s Corp. canceled its curbside operations in August 2022, which it started in 2020. Book retail chain Barnes & Noble Booksellers Inc. no longer has designated curbside pickup spots or outdoor signs about the service. This is “primarily due to declining usage by customers,” a spokesperson says.

But whether or not retailers continue to offer curbside will come down to more than just adoption, says

Emily Pfeiffer, principal analyst at Forrester Research. If this is the only factor retailers consider, they might miss the point of maintaining the service, she says.

“‘How many customers use our curbside pickup?’ may not be the only metric to consider, but rather how is it going? Are we doing a good job? Would more shop with us if we had better curbside?” she says.

Among the retail chains in the Top 1000, conversion rate was highest from 2020 through 2022 for those that offered curbside pickup. That compares with those that offered BOPIS or didn’t offer either service.

There are several factors that could drive consumers to choose curbside pickup over BOPIS, Pfeiffer says. For example, a consumer could be tired or the weather could be bad. The consumer might even have an infant sleeping in the backseat, she says. The consumer might have health concerns, COVID-related or not. Consumers might want to pull up, have their purchase put in their car and “not deal with it,” she says.

“There are some customers who won’t shop with a retailer that doesn’t provide curbside pickup,” Pfeiffer says.

Digital Commerce 360 and Bizrate Insights surveyed 1,069 online shoppers in February 2023 to see which activities were part of their shopping behavior in the prior six months. 35% of respondents said they ordered online for curbside pickup. The same survey found that 50% of respondents chose BOPIS for their orders.

Moreover, a different Digital Commerce 360 and Bizrate Insights survey — of 667 omnichannel shoppers, also conducted in February 2023 — found that about a quarter of respondents used in-store or curbside pickup either three to five times (24%) or six to 10 times (26%) in the prior six months. 17% did so 11 to 19 times, and 18% did so 20 or more times.

When it comes to why, a Digital Commerce 360 and Bizrate Insights survey of 642 omnichannel shoppers in February 2023 found that most respondents chose curbside or BOPIS for their orders to save time (48%) or because they find it more convenient (47%). Moreover, 38% selected curbside because they wanted to avoid going into the store.

Respondents also cited not wanting to pay for shipping (36%) or needing the product sooner than shipping would allow (34%). Similarly, 32% said they wanted the product that same day. Weather accounted for 14% of respondents choosing curbside or BOPIS. And 13% said they chose curbside because they didn’t want to bring children inside the store.

Curbing expectations

Circumstance and logistics played a large role in Daniel’s offering curbside pickup, Sarullo says.

“Malls bent the rules around the pandemic because they wanted their stores to have sales. They didn’t want them to go out of business,” he says. “The parking lots were empty because no one was in the mall.”

But they are not bending the rules anymore.

In 2023, he says, the fundamental challenge with mall-based retailers offering curbside is having to coordinate where 100 different stores in a mall will tell their customers to park. Furthermore, malls would have to develop an easy, logical curbside pickup system that doesn’t block traffic, he says.

Daniel’s no longer formally offers curbside pickup, he says. It stopped offering it in January 2022, when pandemic restrictions were lifted in the states where Daniel’s has physical stores.

“Once the stores opened up, it wasn’t something that was easily kept going forward, not being our own physical location by a street,” he says.

Curbside’s future

Forrester’s Pfeiffer says curbside pickup is not as vital as it once was, but it’s not going away.

She says she expects it to become a seasonal behavior. Pfeiffer cites Forrester data showing a quarter of consumers bought online for pickup over the 2022 holiday season.

“Smaller retailers should continue to pursue how they can offer curbside pickup affordably and effectively,” Pfeiffer says. “If they can’t create a positive experience for customers, they shouldn’t offer it. It’s more detrimental to loyalty to create bad experiences. But they must realize they’re going to lose some sales if they don’t have it at all.”

She adds consumers are less likely to use curbside pickup if it feels confusing, inconvenient or like it will take a long time. Pfeiffer says there could come another time where curbside pickup is necessary again. If that happens, she hopes retailers won’t have “lost all that muscle memory.”

“It might be worth just keeping it alive enough so that we know that we can do it, or whatever the next pivot is, and not get as stuck again as we were when this one hit,” Pfeiffer says.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update!