With the majority of consumers shopping online on Cyber Monday, most top online retailers offered a sale with a deep discount to entice online holiday shoppers to purchase.

In a Digital Commerce 360 site check of 100 major online retailers selling in North America on Cyber Monday (Nov. 28), 89% of them offered a sale related to the holidays.

Plus, 66% of the retailers offered free shipping in some capacity, such as with a minimum purchase. This is a wise move, as free shipping is especially important to online holiday shoppers, according to a Digital Commerce 360/Bizrate Insights survey of 1,088 online shoppers in September. Nearly two-thirds of online shoppers (62%) said a free shipping offer most motivates them to make an online holiday purchase, according to the survey. Shoppers could choose three motivators.

Merchants heavily discounted on Cyber Monday. The median largest advertised discount on retailers’ homepages was 50% off. Plus, more than a third of the 100 retailers — at 36% — offered a sitewide sale. Meaning, all of the merchandise was on sale.

This is an uptick from earlier in November (Nov. 10), when Digital Commerce 360 checked this same panel of 100 online retailers. Then, 51% of retailers ran a sale, with 24% directly referring to Black Friday on Nov. 10, more than two weeks before Black Friday.

“Retailers are once again playing the game of discount chicken, where they execute earlier promotions to drum up demand, only to have consumers wait for that last and biggest deal during Cyber Week,” says Rob Garf, vice president and general manager of retail at ecommerce platform provider Salesforce Inc.

On Cyber Monday, 82 retailers cited Cyber Monday or “Cyber” when promoting their sales, four cited Black Friday, four were general holiday and one retailer offered a sale not citing any holidays or winter.

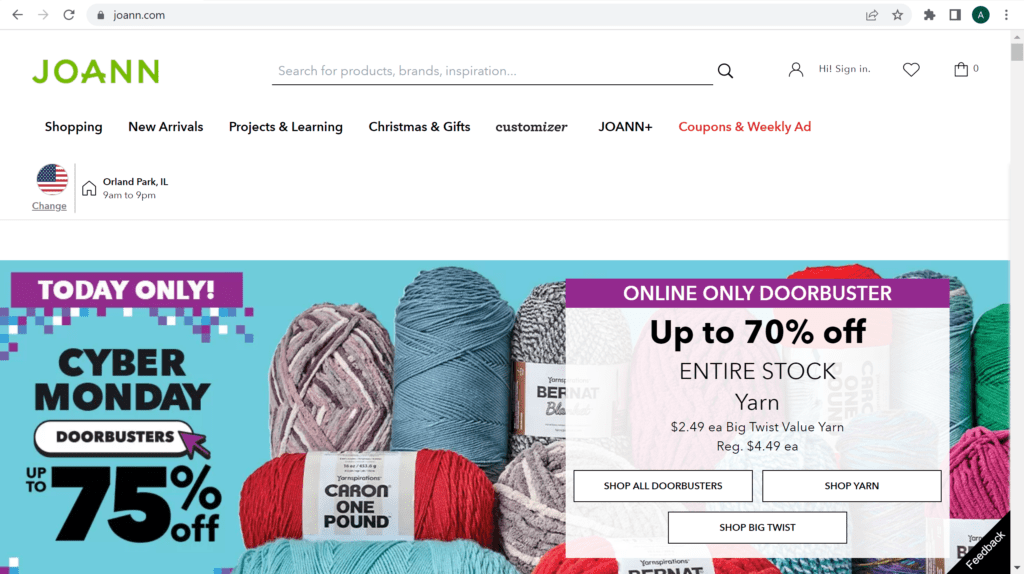

Joann.com’s homepage on Cyber Monday.

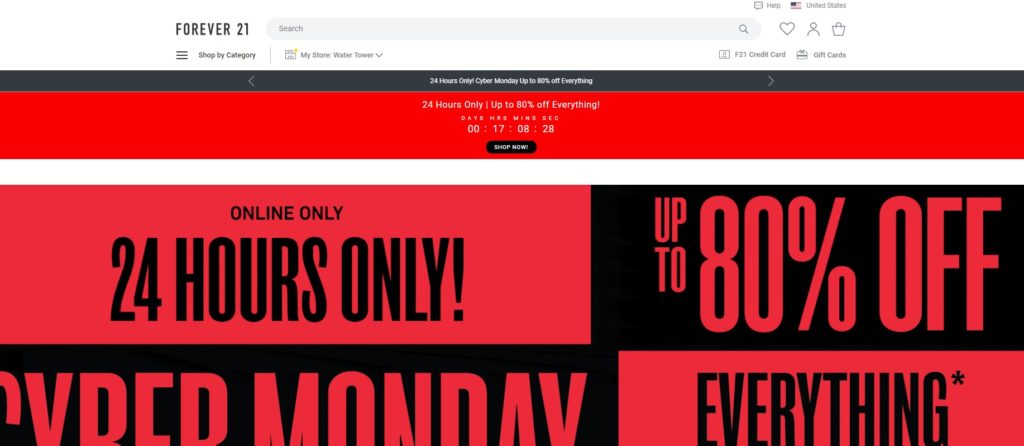

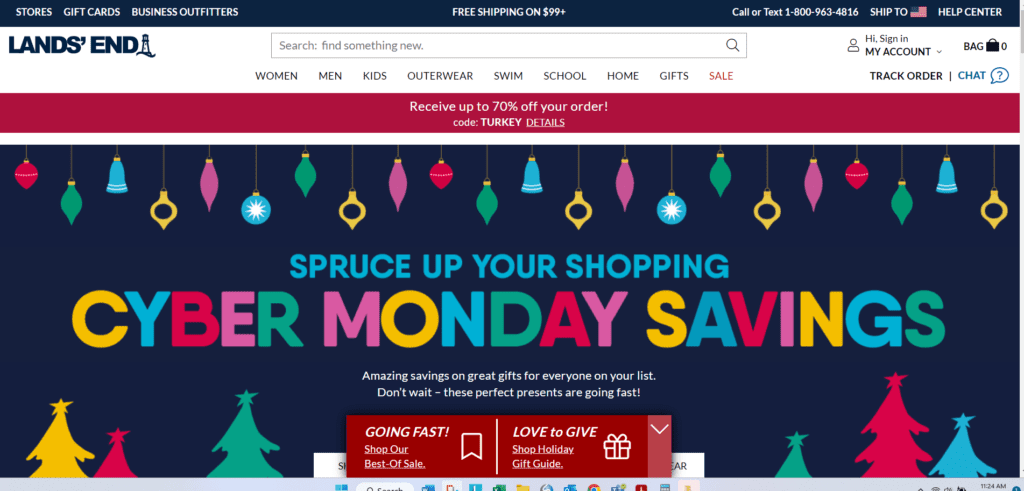

Many merchants were flashy with their offerings, with sales taking over the homepage.

Forever21.com’s homepage on Cyber Monday.

LandsEnd.com’s homepage on Cyber Monday.

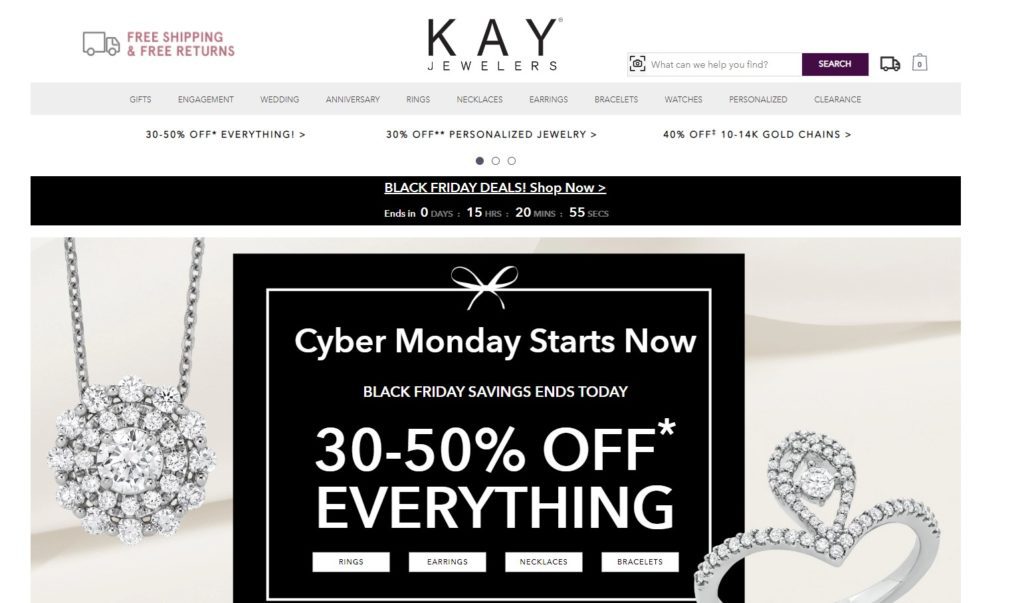

Because so many consumers shop online, there is less of a distinction between the deal days than historically when Black Friday was traditionally for store-based shopping and Cyber Monday traditionally for ecommerce. And so, many merchants make their deals available all Thanksgiving weekend or the entire week starting on Cyber Monday. Jewelry merchant Kay.com, for example, advertised on its homepage on Cyber Monday that its Cyber Monday deals start and its Black Friday deals end that day. Either way, all of its merchandise was discounted between 30% and 50%. Signet Jewelers Ltd., No. 34 in Digital Commerce 360’s Top 1000 database that ranks North American e-retailers by their web sales, owns Kay.com.

Kay.com promotes both Black Friday and Cyber Monday.

Mass merchant Walmart Inc. (No. 2) advertised “deals for days” and apparel merchant The Buckle Inc. (No. 349), for example, said its sale is for “Cyber Week.”

Buckle advertises sales all week on its homepage.

Walmart.com promotes “Deals for Days.”

Because of the constant deals, a number of merchants offer price-matching policies including OfficeDepot.com, Kay.com, BlueNile.com and DicksSportingGoods.com.

Retailers are touting deals today to capitalize on the majority (53%) of online holiday shoppers who said they would shop on Cyber Monday, according to a Digital Commerce 360/Bizrate Insights survey of 1,088 online shoppers in September.

Deals are especially important to online holiday shoppers in 2022, as economic pressures are impacting their gift spending. Many shoppers say they will comparison shop more, spend less or make fewer purchases this holiday season, according to the survey.

And retailers know this and responded with more promotions this year compared with Cyber Monday 2021. When looking at a subset of 55 of the largest online retailers year over year, 96.3% offered a Cyber Monday sale in 2022 compared with 88.9% in 2021. Plus, 40.7% offered sitewide sales this year compared with 24.1% in 2021. However, the median largest advertised discounts was 50% both years.

More promotions is in contrast to last year, when supply chain issues allowed retailers to not have to discount so heavily, Garf says.

“Discounting has bounced back compared to last year, when retailers weren’t compelled to offer aggressive deals due to inventory scarcity and high demand,” Garf says.

But because of inflation, these discounts may not be as good as they seem, Garf adds.

“Even with aggressive discounts, consumers are likely going to spend the same as in previous years, but they’re just getting less bang for their buck,” Garf says.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite