“We’ve got to meet customers where they are — and that’s Amazon,” says Hanna Houglum, vice president of online tea retailer Art of Tea.

But if you’re a small- to medium-sized business, how do you stand out among a sea of competitors? How do you ensure your products pop up during a customer’s search?

These are questions Houglum addresses during her weekly meeting with Art of Tea’s in-house Amazon account manager. The retailer hired one in 2021 specifically to manage marketing and selling through its Amazon store.

“That’s part of the hardship of being smaller on such a huge marketplace,” she says. “You don’t really have the resources or the staff or the budget to invest enough to keep up with what Amazon is doing. And Amazon keeps a lot of what they do under wraps. We sometimes get surprises like dashboard changes or reporting changes or not being able to send inventory. We have to keep an open mind and concentrate on being flexible.”

Managing inventory on Amazon is a constant reassessment of how products are titled, described and laid out visually, Houglum says. If you search for the keyword “tea” on Amazon, thousands of products populate. To stand out, smaller retailers need to identify keywords that will not only convert into a sale but will do so at a cost that makes sense to the business, Houglum says.

Re-think the search process

Those keywords segue into key phrases — what a customer types into the Amazon search bar to help find something they might not be sure of themselves. They’re hoping Amazon’s algorithm will lead them to relatable products. So, Art of Tea focuses on key phrases or related topics shoppers might be searching for. “We’re not focusing on the keyword ‘tea,’” she says.

“Customers are often looking for a solution to a problem, like a sleep remedy. We want to show up as that solution to their problem,” Houglum says.

Art of Tea declined to share how much of its overall web sales are from Amazon, or which keyword phrases are most successful. Its Amazon average order value is about $40 compared with its direct-to-consumer (DTC) website, with an average order value (AOV) of $65 to $70.

“We want to be available to the Art of Tea customer that wants to try our tea or buy their favorite with two-day Amazon Prime shipping,” Houglum says.

Tracking granular customer information on Amazon is notoriously difficult, Houglum says.

“From our experience, Amazon keeps customer details close,” she says. “We are not able to track who is visiting our Amazon store except for our Subscribe and Save volume, which has been a breath of fresh air knowing that if people are subscribing, there is some kind of retention happening.”

Amazon allows sellers to send marketing emails to loyal customers

Over the last year, Amazon has loosened its grip on some of the customer information it collects. In September 2022, Amazon announced it would give sellers the ability to use the Amazon Customer Engagement tool to send marketing emails to their most loyal customers. The new tool includes repeat customers (from the previous 12 months), recent customers, and high-spend customers. Previously, sellers could only use the email marketing to communicate with customers who followed a brand on Amazon.com.

Amazon’s Customer Engagement tool now allows sellers to email their most loyal customers, including repeat customers, recent customers, and high-spend customers.

“This is a wonderful expansion on the current emailing capabilities, which currently only allows you to speak with brand followers,” says Bart Tashakor, Art of Tea’s ecommerce manager. “The expansion of remarketing will help Art of Tea keep in contact with any customer that has purchased from us and allow us to keep them informed on the latest developments and opportunities.”

Amazon tool identifies popular items

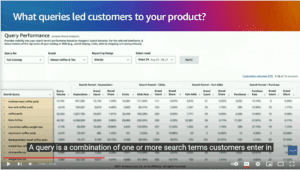

The latest capability is in addition to its November 2021 introduction of a query tool for sellers to access data on search keywords.

In November 2021, Amazon launched a search analytics tool that allows sellers to review what customers are searching for and how many customers clicked and ended up buying that product.

“Amazon doesn’t get enough credit for this. They have enhanced the data they provide to brands over the last year,” says Fahim Naim, head of Amazon at Advantage Unified Commerce, an ecommerce consulting agency.

“You can look at different search queries and review the most popular items for that search. How many customers searched it, how many customers clicked on it and how many bought your product,” Naim says. “You can run advertising based on this information. It’s not as clear as the data you’d get tracking your direct-to-consumer website through Google Analytics. But from a search perspective, you have a pretty good amount of visibility now as a brand on the platform to see what search terms customers are searching to get to your product.”

This can help brands run ads and update keywords accordingly, Naim says.

Sellers test different tactics to reach shoppers

To reach customers in a crowded marketplace like Amazon, retailers must understand how customers think and shop. It’s not as simple as mirroring a direct-to-consumer website. It’s an evolving process with ever-changing keywords and fluctuating costs.

To stand out, retailers must tailor their product listings to coincide closely with what shoppers are searching for — and follow the data. For Art of Tea and bra retailer Leading Lady, that meant hiring dedicated Amazon account managers or agencies as well as investing in technologies to help track and analyze progress. But merchants must ensure that whoever they hire understands the products and the target customer well enough to outsell competitors.

Art of Tea tests different keywords and product bundles. Bra retailer Leading Lady tweaks its Amazon product pages to have more information than its own website. It does this to better appeal to shoppers on the marketplace. Meanwhile, Curist, which sells allergy, heartburn, and cold and pain medications, finds it has to be creative because it can’t outbid its larger pharmaceutical giant rivals on popular keywords.

Marketplaces grow more popular

Retailers are looking to marketplaces to reach new customers. And U.S. marketplaces continue to grow. According to Digital Commerce 360 data, marketplace growth exceeded that of other forms of retail in 2021. The Top 100 U.S.-based marketplaces recorded 18.7% growth in total gross merchandise value (GMV) in 2021 to reach a record high of $917.79 billion, according to Digital Commerce 360 estimates.

In 2021, U.S. retail sales growth held fast at 14.4%, according to a Digital Commerce 360 analysis of U.S. Department of Commerce Data. Total U.S. ecommerce sales growth rose 17.8%. In other words, marketplaces are outpacing total ecommerce growth.

In a sea of sellers — some of which have very big marketing budgets — it can seem daunting for smaller retailers to stand out. The pandemic prompted a lot of retailers to try their hands at selling on marketplaces to reach a wider audience. In 2020, Amazon.com Inc. added more than 200,000 new third-party sellers from around the world, a 45% year-over-year increase from 2019, according to the marketplace. It’s an arena more DTC retailers are finding necessary to reach a new band of customers.

Art of Tea prepares early for the holiday rush

Art of Tea spends most of the year building up to the fourth quarter, Houglum says.

“Every decision to promote products through deals and CPC during the year is made with the thought of building our launch pad as high as possible for Q4,” she says. “For that reason, we began sending inventory to Amazon in early June to help ensure we had healthy stock levels at Amazon leading up to Q4.”

Art of Tea’s current goal is to have at least 80% of its inventory to Amazon by October. Marketing won’t matter if the products aren’t in stock, so Art of Tea is well ahead of the holiday rush to stock up on what it believes customers will want to buy.

“We plan to send all our Q4 inventory at once so we do not have to worry about whether Amazon will allow us to replenish inventory should we run out,” Houglum says.

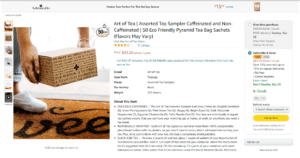

Art of Tea is updating images as well as product descriptions to remove any of the guesswork new customers might have when reviewing their products. Marketing to Amazon shoppers goes beyond ads; it is how product items are described. Longer descriptions with more detail work best, Houglum says.

“It might be as simple as highlighting that something is caffeine-free or contains lemongrass, or is an herbal tea blend,” she says. “Those are the details we would never include in a product [title] name on our DTC website. But Amazon shoppers want more information when they find us during their search.”

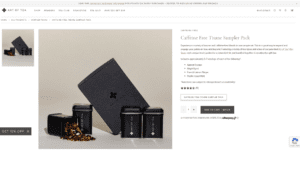

Art of Tea product descriptions on Amazon (above) are noticeably longer and more detailed compared with the retailer’s DTC website (below).

Using technology to analyze data

Art of Tea tracks keywords using Helium 10. The software helps the retailer track the cost per click. Cost per click (CPC) is when advertisers pay for each time a consumer clicks on an ad. Houglum declined to say what it pays for the service. The vendor has multiple plans starting at $29 a month with some product and keyword data tracking. Prices increase to $84, $209, $399 and up, depending on a retailer’s needs.

The retailer uses several tools to help its keyword searches in Amazon. It uses Magnet, an Amazon keyword planner, to find new keywords that it otherwise didn’t realize were worthwhile. The Misspellinator tool within Helium 10 helps retailers target common misspelled keywords. It targets variations of misspelled key terms the brand should also be aware of.

“We’ll notice month-over-month a shift in keyword popularity [on Helium 10],” she says. “You can’t just set your product descriptions on Amazon and think, ‘It’s OK, we’re done.’ It’s a labor of love for every word. Everything is changing, and more and more brands come onto this marketplace every day.”

Art of Tea also uses Camelcamelcamel to track minimum advertised price (MAP) violations. This is when an unauthorized seller is selling Art of Tea products for less than its MAP price.

“With this tool, we can track and see if there was an anomaly in our pricing that affected sales,” Houglum says.

The retailer can check against how sales change based on pricing and adjust accordingly.

Art of Tea’s DTC website runs using Shopify Plus. To offer customers a similar, easy, mobile shopping app experience like Amazon, it invested in Tapcart. Tapcart is a mobile commerce software that integrates with a retailer’s existing Shopify website.

Beyond Amazon, Art of Tea also is selling on Walmart’s marketplace. It plans to integrate its 10 best-selling SKUs on Walmart.com by the end of 2022.

Bra retailer invests in outside agency to strategize on Amazon

For nearly 80 years, Leading Lady has manufactured women’s bras. Recently, the retailer began focusing on on selling directly to shoppers through its own website and on Amazon and away from wholesale.

Leading Lady has sold its garments through its Amazon store for nearly 15 years. “But the consumer is evolving. We realized we needed to evolve as a brand to have a better chance at capturing their attention and that sale,” says Barbara Shears, marketing director.

Like so many online retailers, Leading Lady experienced a COVID-19-related jump in sales. But after a flurry of activity, momentum subsided going into 2021, Shears says. In 2020, the retailer experienced a 50% increase in web sales, followed by a 10% increase in 2021. In 2022, sales are softer than expected, Shears says.

“Sales dropped and got worse and worse. We needed to make another change,” she says.

That change led to hiring an independent marketing agency in March 2021. The agency helps the retailer navigate the marketplace and update its listings. Since then, monthly revenue has grown 81%, and return on ad spend, which refers to the amount of revenue earned for every dollar spent on an advertising campaign, has increased 26%.

The specialty bra retailer sells an assortment of bras including hard-to-find sizes, which affects the keywords it targets. About 25% to 30% of Leading Lady’s web sales come from its Amazon store.

Leading Lady devotes 85% of its marketing budget to digital ads, search engine marketing and Facebook.

Solving the Amazon problem

Like Art of Tea, Leading Lady started with defining how it can help a shopper solve a problem. Leading Lady’s customers are often on the search for hard-to-find sizes with the added convenience of fast, free delivery.

Shears says previous vendors it used to manage its Amazon store didn’t understand its products or customers well. For example, 30% of Leading Lady’s customers are men, Shears says. And nursing bras are one of the top sellers for the retailer’s Amazon shop.

After cycling through several Amazon account vendors, Shears says the retailer realized that the value of its listings is in helping the customer understand the products. This means it needed more details written within the image and in the product description to capture a shopper’s attention quickly, Shears says. Its new vendor is helping the retailer with this initiative, she says, without providing specifics.

“It took me a lot of time — about a year and a half — of digging into Amazon to understand what is important,” she says. “And what is important is investing in an agency to help us optimize our listings and bring them up to today’s standards.”

With past vendors, Shears says Leading Lady was left with sitting inventory. Leading Lady has over 11,000 SKUs listed on Amazon.

“It becomes difficult to bring on vendors that understand the nuances of your industry and therefore know how to showcase it properly,” Shears says.

“We ended up sending back a lot of inventory because nobody was doing anything to promote inventory we actually had available [on Amazon],” Shears says. “It was a big mess. Now we’re taking a more assertive approach.”

Leading Lady’s bra descriptions are longer on Amazon.com compared with its DTC website (below). The retailer also includes more information in the images. This includes sizing information to ensure a shopper can see features quickly and easily.

Curist appeals to customers who want a cheaper alternative

Allergy and pain relief retailer Curist has the added complication of selling a product customers ingest to relieve heart burn or allergy symptoms. That involves an extra layer of trust, says founder and CEO Ethan Goldstein.

Each of Curist’s products have a different set of competitors. And some of those competitors have a much larger marketing budget, Goldstein says.

“They can spend a lot more on ads, which makes overall costs go up,” Goldstein says. “With some of the products we’ve launched, we’ve just been outbid on keyword prices.”

The majority of Curist’s business is on Amazon; therefore, most of the retailer’s advertising budget goes toward its Amazon store.

“We know that the better a product sells, the more likely it’s going to show up higher on an organic search,” Goldstein says. “And that flywheel effect is that as you spend on ads on Amazon — that hopefully generate sales — your listing will appear higher and be better ranked for organic searches.”

Good reviews also factor into that. The better the reviews, the better the ranking, he says. But the goal is to generate more revenue than what is being spent on advertising. That’s been more difficult in 2022, he says. The average CPC for 2022 is 20% higher compared to what the retailer paid in 2021 and 2020.

Doing the math

In this market, it takes more than being efficacious, Goldstein says.

“Affordability is a big aspect of what we do,” Goldstein says. “There could be 100 different allergy products available. We want to streamline that decision for the customer.”

Curist’s products cost 25% to 50% less than a popular brand. Its Amazon shop gained traction during COVID-19 when competitors went out of stock.

“You can’t advertise on Amazon if you don’t have inventory in stock,” Goldstein says. “That was a big opportunity for us.”

As the pandemic ebbs, Curist’s competitors have replenished their inventory and can keep up with demand again. Curist is now focused on attracting customer loyalty.

“We weigh marketing dollars carefully and ask ourselves whether it makes sense,” Goldstein says. “We don’t have a large budget where we can overspend in the hopes that people will come back later.”

For example, if a retailer is selling a product for $10 and the cost for a click is $10, and the conversion rate is 50%, that means the retailer is paying $20 to get a $10 sale.

“We’ve had scenarios like this where we were just shocked,” Goldstein says.

“We play in the same field as a lot of big pharmaceutical companies, and they have really big budgets,” he adds. “It can be difficult to get any sort of momentum because we’re simply outbid at every turn.”

Curist offers clear, simple descriptions for its allergy and pain relief products. Products typically cost 25% to 50% less than a popular brand.

Curist pays attention to Amazon ad spending

Goldstein keeps a close eye on its Total Advertising Cost of Sales (TACoS), which is a measurement of a retailer’s reinvestment into Amazon ads. This number is important because Amazon doesn’t share a granular level of data, Goldstein says. Like Art of Tea, Curist knows what percentage of its customers are “Subscribe and Save” customers.

Amazon’s latest move to allow retailers to email repeat customers sounds promising to Goldstein. Curist runs email marketing for its existing DTC website and plans to use Amazon’s email marketing to be an expansion of that program, he says. He expects Amazon to launch email templates, “so there may not be a ton of ability to customize the language,” he says. “But just sending an email, having that digital reminder about our brand, will be valuable.”

When selling on Amazon, retailers know that being found is one part of the equation. It is important for retailers eager to stand out on a marketplace to devote a separate strategy to devise different language, visuals and inventory that solve a shopper’s problem. Customers want more information up front. The less guesswork, the better.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite