Amazon.com Inc.’s Prime Day started Monday and will span over 48 hours from June 21-22. And many retailers are offering their own sales to take advantage of more consumers shopping online.

Prime Day 2020 generated a Digital Commerce 360-estimated $10.40 billion in sales globally over the two-day period, up 45.2% from $7.16 billion during the 48-hour event in July 2019. And, online consumer spending during the Prime Day shopping event is not limited to just Amazon.com. Online spending in the U.S. will hit an estimated $12.2 billion during the sale, with Amazon capturing 60%, according to market research firm EMarketer Inc.

Retailers challenge Prime Day

As with other years, retailers are combating Prime Day with their own sales. Digital Commerce 360 analyzed the top 250 retailers tracked in the Digital Commerce 360 Top 1000 to see which retailers were offering a sale directly competing with Amazon.

On June 21, 50.8% (or 127 retailers) among the top 250 retailers offered a widespread sales event on their ecommerce site. This is up from last week, when Digital Commerce 360 found that 44.8% of retailers, or 112 of the top 250, retailers had a large sale the Monday before Prime Day, June 14. The widespread sales last week generally were related to Father’s Day holiday (which occured June 20), graduations or other general sitewide sales. The median discount June 14 was 40%, but retailers increased their discounts to a median 50% off on June 21, according to Digital Commerce 360.

Some merchants offering sales on June 21 were marketing shorter sales, spanning the same days as the Prime Day event. However, Walmart Inc.’s “Deals for Days” and Target Corp.’s “Deal Days” both began Sunday, June 20. Walmart’s sale ends on June 23, the day after Prime Day, and Target is having a three-day sale. Walmart (No. 2 in the Top 1000) is boasting 30-60% off products in various categories, while Target’s (No. 6) homepage features flash deals up to 20%, as well as 50% off other products.

While merchants often have large sales, as Digital Commerce 360 found last week, many retailers used Prime-related language on June 21 to drive home the fact that these sales were in direct competition with Amazon’s sales event. On June 21, Digital Commerce 360 found that 27.2% of the top 250 retailers, or 68 retailers, mentioned some sort of Prime-related wording to advertise their sales, offered online-only discounts or emphasized their sale was short-lived, typically one or two days.

Prime-related marketing on retailers’ homepages includes:

- Musical instruments retailer Sweetwater advertised “Prime-Time Deals”

- Apparel retailer Brooks Brother’s advertised “Summer’s Peak Time, June 21 & 22 Only”

- Furniture retailer Ashley Furniture advertised “Online Only 48 Hour Summer Sale”

- Home electronics retailer Monoprice advertised “The Great Big Sale Event, Up to 80% Off, Ends 6/22”

- Shoe retailer DSW threatened “Two. Days. Left.”

In a snarky nod to Prime Day deals only being available for Amazon.com’s Prime members, The Home Depot Inc. called out that its sale had “No Membership Required.”

Home Depot boasts its lack of membership for shoppers looking for savings.

Other online sales on June 21 include:

Wayfair Inc. emphasizes the urgency of its sale, even if it lasts longer than Amazon’s 48-hour sale.

New York & Company plays on the Prime Day theme with its own two-day sale.

Joann.com’s 48-hour sale uses Prime-related language.

Kay Jeweler is another retailer using Prime-related language to advertise its sales.

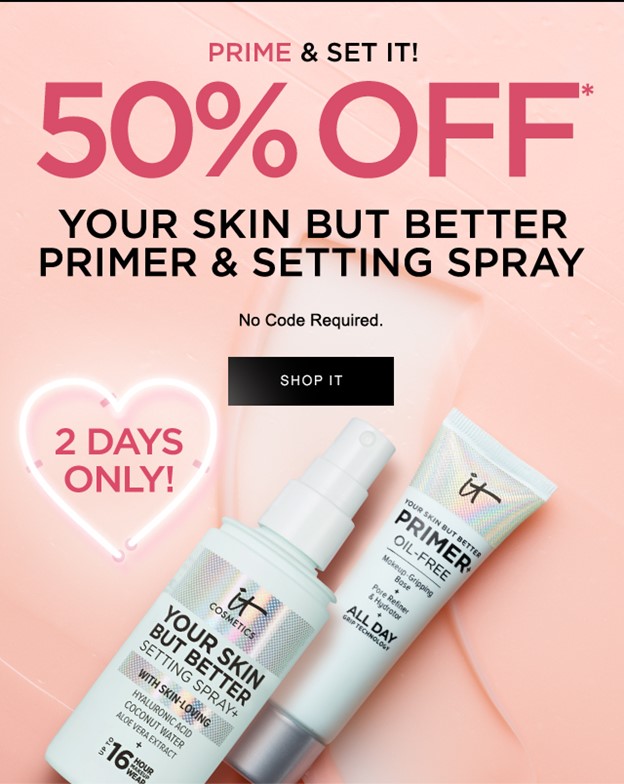

IT Cosmetics uses its own products—makeup primer—to advertise its two-day sale with a nod to Prime Day.

The Prime Day challenge

While the online deals are widespread during Prime Day, discounts are not always the best way to build loyal shoppers, says Payal Hindocha, director, go to market, at customer engagement platform Emarsys.

“The challenge for online retailers is how to attract customers to buy directly from them, rather than through Amazon,” Hindocha says. “While competitive deals are a huge draw… discounts alone do not build loyalty or guarantee repeat purchases in the long term.”

In fact, some Amazon marketplace sellers say that the Prime Day deals will be stingier this year, thanks to rising shipping costs, higher advertising rates and scarce inventory. “There’s growing deal fatigue on Amazon,” said Peter Darch, who manages inventory and supply chain at Perch, which owns several brands that are popular on Amazon. “We’re being a little more selective with deals.”

Amazon marketplaces sellers, who account for 60% of sales on the website, are betting cash-rich consumers will overlook the more meager bargains and still swarm Prime Day. Amazon brands will once again take center stage, with deals on surveillance doorbells from the company’s Ring division and a voice-activated Echo device for cars that will go for $15.

After delaying Prime Day in 2020, Amazon this year moved the sale forward from its typical July slot to June—giving merchants only three weeks’ notice. But this is less than a year since the COVID-19-delayed Prime Day, held Oct. 13-14, just ahead of the holiday season. Typically, sellers like to place orders with factories several months in advance so the products can be shipped to the U.S. in time. The abrupt announcement means many merchants will have a more limited selection than they would with a longer lead time.

“Amazon just picks a date, which makes it very hard to plan, unlike a July 4 sale you can count on every year,” said Melissa Burdick, a former Amazon executive who is now president of Pacvue, an online marketing consulting firm. “So, there’s not a lot of distinction or variation. You get a lot of Instant Pots and Bose headphones.”

Digital Commerce 360’s editorial and research director Fareeha Ali discusses Prime Day in more depth on a segment on CBS This Morning. Watch below.

Bloomberg and the Digital Commerce 360 staff contributed to this report.

Favorite